Skift Take

The Chinese traveler’s gradual return proceeds to effects worldwide journey. But adventure tourism operators are optimistic they will be parachuting into recently opened group vacation nations like Australia.

Thrill-seekers from China have a renewed fascination in experience vacation to Australia and New Zealand, with just one adventure tourism operator, Knowledge Co, looking at a direct raise, according to its money update on Thursday.

The New South Wales-based enterprise specializes in adventure tourism experiences from safaris, skydiving, and scuba diving and noticed an uptick in New Zealand throughout the early stages of China’s Golden 7 days getaway in late September.

Ord Minnett senior researcher John O’Shea expects that expansion to unfold. “We anticipate a similar predicament to unfold in Australia around the coming months, given New Zealand’s before acceptance as an Accepted Spot Standing for Chinese tour teams,” explained O’Shea. New Zealand was cleared for Chinese team vacation in January of this year, however China only lifted its team vacation restrictions for Australia in August.

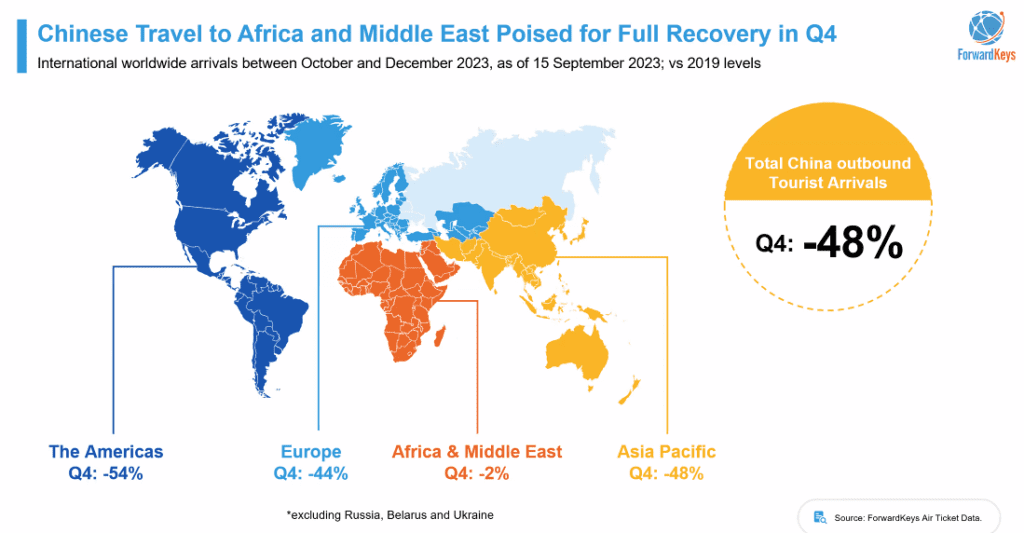

The travel appetite of the Chinese traveler has still to thoroughly return, with outbound travel from China noticeably beneath 2019 concentrations. Dragon Path and ForwardKeys industry analysis just in advance of the peak October journey period of time also showed that 55% of respondents in a Chinese Traveler Sentiment Report planned to vacation inside Asia.

‘An Intercontinental Opportunity’

Earlier in 2023, Expertise Co invested in reconstruction projects for its Wild Bush Luxury and Treetops Experience enterprise and has observed a return to typical customer quantities.

Experience Co also obtained the Australian Jump Pilot Academy for its Overall performance Aviation business enterprise device in April to deal with its labor constraints in anticipation of a return to pre-pandemic visitor quantities.

“It is really about guaranteeing that we have a continual pipeline of pilots and pilot capability to make it possible for us to flex back again to those pre-pandemic amounts in our Skydive functioning segment. Even though Australia’s inbound restoration is amazing news, the name of the activity for EXP is really down to the return of the global marketplace and, in distinct, the Chinese traveler. The global prospect stays,” stated Expertise Co CEO John O’Sullivan.

Reopening group vacation for Australia and New Zealand is also predicted to boost aviation capacity.

Earnings Increase from Journey Experiences

Experience Co claimed revenues of $68.54 million (AUS$108.6 million) for its 2023 fiscal 12 months, which finished 30 June, and EBITDA of $7.13 million (AUS$11.3 million). The internet decline right after tax was $316,175 (AUS$500,000).

The Experience Experiences section was a critical driver, contributing $8.52 million (AUS$13.5 million) to the EBITDA, a significant improve from $3.53 million (AUS$5.6 million) in 2022.

Its Skydive business enterprise phase also improved, publishing an fundamental EBITDA of $2.59 million (AUS$4.1 million), as opposed to a decline of $1.33 million (AUS$2.1 million) in the earlier fiscal calendar year.

Hunting in advance: Investment financial institution Ord Minnett forecasts the firm will make earnings of $85.9 million (AUS$136.1 million) in the 2024 fiscal 12 months. Chinese in-bound tourism will play a role.

More Stories

How Easy is It to Migrate to the UK?

Can Damaged Money Be Exchanged at a Money Changer?

Four Travel Tips for London